child tax credit 2022 extension

However many want it to be made permanent eventually. A recent study published by the urban institute shows that if the child tax credit is extended beyond 2021 it.

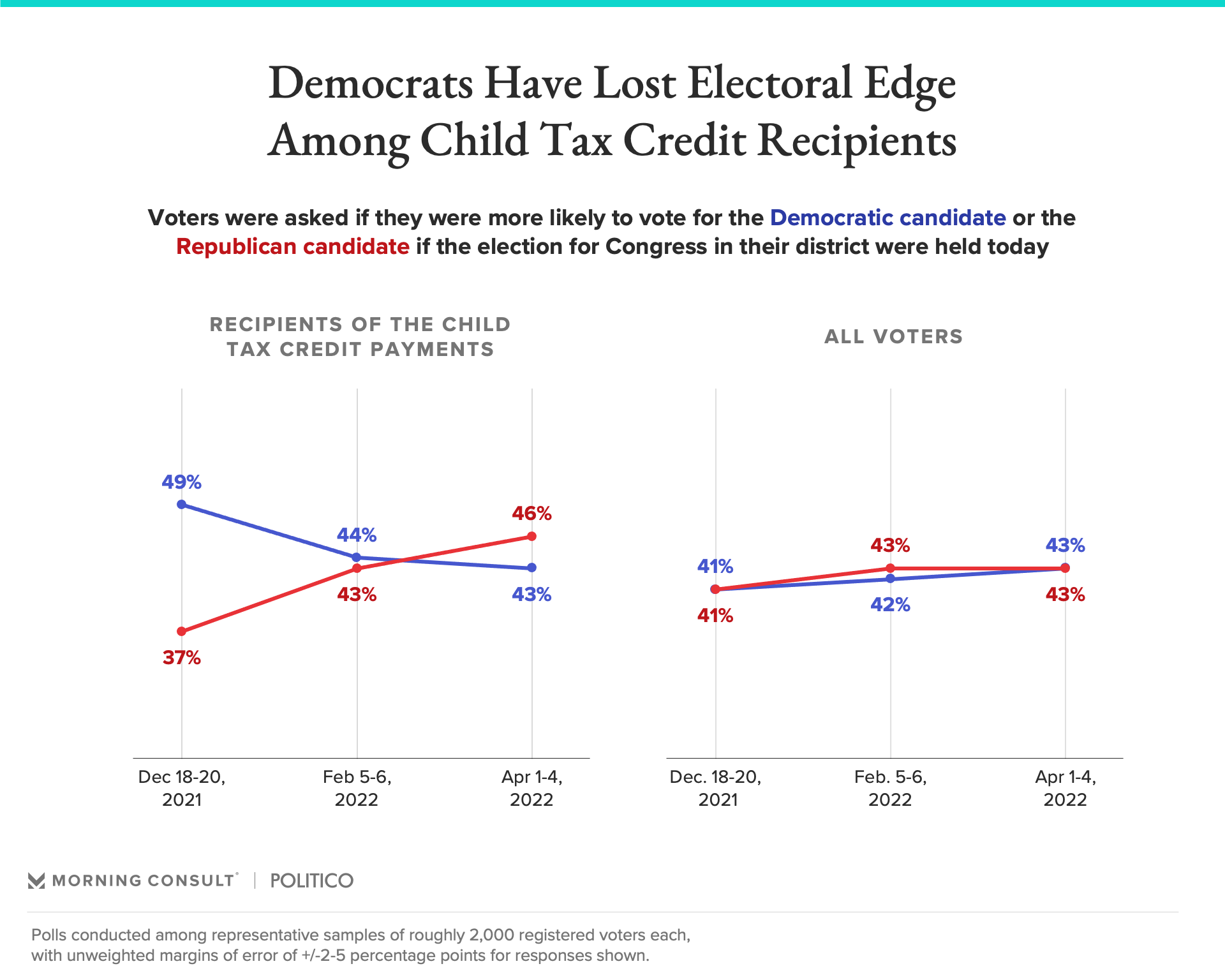

Republicans Favored To Win Senate Among Child Tax Credit Recipients

However for 2022 the credit has reverted back to 2000 per child with no monthly payments.

. The Biden administration originally proposed extending the payments through 2025 but that proposal was reduced to just one additional year. Here is what you need to know about the future of the child tax credit in 2022. How much have gas prices increased in 2022.

The build back better framework will provide monthly payments to the parents of nearly 90 percent of american children for the 2022 year. THE child tax credit payments have helped millions of Americans financially in 2021 but some are wondering if they will continue beyond this year. 10 hours agoThe credit has been found to be effective at reducing poverty.

Citing a difference in helping child poverty President Biden wants to continue the child tax credit CTC payments. The good news is. Did Child Tax Credit Get Extended 2022.

8000 child tax credit medicare cola 2022 benefits. 2022 Child Tax Credit. 2022 Child Tax Credit Extension.

A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of. As part of the American Rescue Act signed into law by President Joe Biden in March the child tax credits were expanded to up to 3600 per kid from the previous 2000. And specifically the extension of the expanded child tax credit.

The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. The American Rescue Act of 2021 temporarily increases the Child Tax Credit up to 3600 per child under age six and up to 3000 per child under age 18. As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered to families.

Eligible parents can receive 3600 for each child under 6 and 3000 for each child under 17 on their 2021 tax returns which are due April 15 2022. For parents the child tax credit is a big deal. Budget restraints only allowed the credit revamp to be temporary.

The Size Of The Credit Will Be Cut In 2022 With Full Payments Only Going To Families That Earned Enough Income To Owe Taxes A Policy Choice That. The benefit is set to revert because Congress didnt pass an extension of the enhanced benefit nor an. The motley fool in 2021 and 2022 the average family will receive 5086in coronavirus stimulus money thanks to the expanded child tax credit.

The child tax credit isnt going away. But without intervention from Congress the program will instead revert back to its original form in 2022 which is. Under the American Rescue Plan Act of 2021 eligible taxpayers who received advance payments of.

Making the credit fully refundable again would reduce child poverty by roughly 20 percent lifting an estimated 2 million children above the poverty line and help millions of others. Cash in on child tax credit. Previously the credit was 2000 per child under the age of.

The new measures created an Enhanced Child Tax Credit. An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17. The enhanced Child Tax Credit payments where distributed last year from July through December.

A couple of examples demonstrate the impact in 2022. This tax credit is changed. 8000 child tax credit medicare cola 2022 benefits.

However Congress had to vote to extend the payments past 2021. President Bidens 2 trillion Build Back Better social spending bill would have continued the the Child Tax Credit through 2022. Income thresholds of 400000 for married couples and 200000 for.

President Biden then settled on a one-year extension for 2022 and wrote that language into his. New research shows a permanently expanded child tax credit. Child Tax Credit extension.

As of right now the 2022 child tax credit which you would get when you file in 2023 is set to go back to 2000 for each dependent age 17 or younger. Fri 18 Mar 2022 0800 EDT Last modified on Fri 18 Mar 2022 1159 EDT. Government disbursed more than 15 billion of monthly child tax credit payments in July to American families.

The boosted Child Tax Credit did so much good that lawmakers initially sought to make it permanent. A single mother with a toddler and a child in elementary school works part time around her kids schedule earning 15000 a year as a. Not only that it would have modified it to include the following.

2 days agoPrior to the expansion and boost to the Child Tax Credit in the spring of 2021 under the American Rescue Plan the last revision of the tax code in 2017 the Tax Cut and Jobs Act TCJA doubled. How Expansion Could Eliminate Poverty for Millions. The legislation made the existing 2000 credit per child more generous.

Whats more in the second half of 2021 it became possible to receive the Child Tax Credit payments on a monthly basis before receiving the second half of it as a lump sum once the individuals.

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Stimulus Update Could 300 Monthly Federal Child Tax Credit Be Made Permanent Cleveland Com

/cdn.vox-cdn.com/uploads/chorus_asset/file/23392681/1235261204.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

Can T File Your Tax Return By Midnight Here S How To File A Tax Extension Cnet

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Child Tax Credit Schedule 8812 H R Block

Parents Guide To The Child Tax Credit Nextadvisor With Time

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Families Aren T Getting Child Tax Credit Checks For First Time In 6 Months

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

The Anti Poverty Targeting And Labor Supply Effects Of The Proposed Child Tax Credit Expansion Bfi

Child Tax Credit 2022 Payment Schedule Nine States Are Offering Checks Up To 1 000 Is Yours Giving Extra Cash

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget